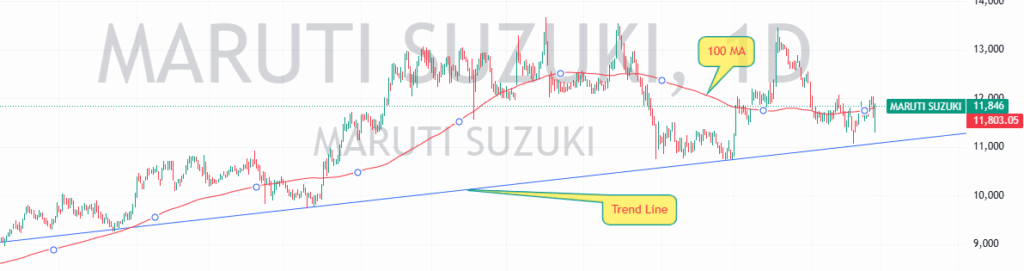

Maruti Suzuki Chart Pattern: Price Action & Moving Averages

Maruti Suzuki Chart Pattern is exhibiting strong support on a long-term trend line while crossing above the 100-day moving average (100 MA)—two signals that often indicate a shift in momentum.

Key Technical Observations:

✔️ Trend Line Support: The price has been consistently respecting this trend line, implying renewed buyer interest at crucial levels.

✔️ 100 MA Crossover: Breaking above the 100 MA suggests improving sentiment and potential price strength.

Fundamental Analysis: Financial Performance & Growth Drivers

Maruti Suzuki’s fundamental outlook remains promising, despite short-term margin pressures due to rising input costs and industry-wide challenges. The company’s export-led strategy, robust SUV sales, and focus on fuel-efficient models position it well for future growth. Below is an in-depth fundamental assessment based on the latest financial data

Fundamental Snapshot (FY25A – FY27E)

| Metric | FY25A | FY26E | FY27E |

|---|---|---|---|

| Revenue (₹ Mn) | ₹1,519,001 | ₹1,700,560 | ₹1,910,985 |

| EBITDA (₹ Mn) | ₹177,852 | ₹205,768 | ₹236,962 |

| EBITDA Margin (%) | 11.7% | 12.1% | 12.4% |

| Adj. Net Profit (₹ Mn) | ₹139,552 | ₹155,929 | ₹181,572 |

| Adj. EPS (₹) | ₹443.9 | ₹496.0 | ₹577.5 |

| PE Ratio (x) | 26.4 | 23.6 | 20.3 |

| ROE (%) | 15.7% | 15.7% | 16.3% |

Growth Drivers & Challenges

🔹 Export Growth: Exports grew 8.1% YoY and are expected to surge 20% YoY in FY26, driving the company’s expansion despite domestic demand fluctuations.

🔹 SUV Dominance: SUVs account for ~45% of total sales, reinforcing market leadership in high-demand segments.

🔹 Margin Pressure: Higher commodity costs, increased advertising spend, and seasonal expenses led to a 177bps YoY EBITDA margin decline.

🔹 Future Outlook: Management expects steady retail demand and strong momentum in EV & fuel-efficient models, supporting sustained profitability.

Conclusion

The Maruti Suzuki chart pattern suggests a potential bullish structure supported by technical signals. Meanwhile, the company’s fundamentals remain strong, with export-led growth, a shift toward SUVs and EVs, and strategic pricing decisions to offset rising costs.

Leave a Reply