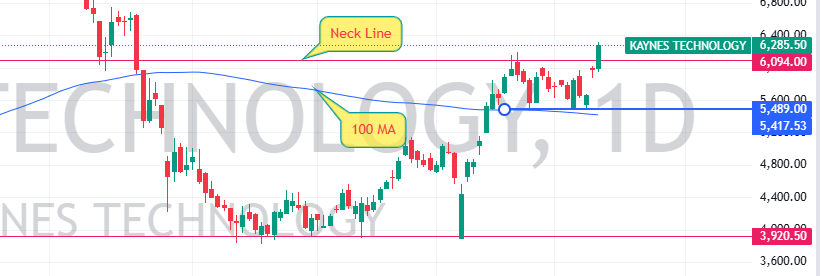

When it comes to smart stock trading, timing a breakout is often the key to success. One such textbook breakout has recently been spotted on the chart of Kaynes Technology Share, a company known for its role in the electronics manufacturing services sector. The daily chart is flashing a powerful Cup with Handle pattern that savvy technical traders are watching closely. What makes this setup even more compelling? The 100-day moving average (100 MA) has acted as a reliable support level, lending credibility to the pattern.

Let’s dive into the technical details and understand why this setup is gaining attention.

☕ What Is a Cup with Handle Pattern?

Before we talk specifics about Kaynes Technology, it’s important to understand the Cup with Handle formation.

A Cup with Handle is a bullish continuation pattern that signals a pause followed by a potential resumption of an uptrend. It consists of two parts:

- The Cup: A rounded bottom that resembles a “U” shape. It represents a period of consolidation after a previous rally.

- The Handle: A slight pullback or sideways movement after the cup, forming a mini-consolidation before the breakout.

When the stock breaks out above the neckline or resistance formed by the highs of the cup, it’s seen as a bullish signal backed by demand and investor confidence.

🛠 Kaynes Technology Share: Technical Setup Breakdown

Looking at the daily chart of Kaynes Technology, here’s what we observe:

- The stock experienced a rounded bottom, forming the classic “cup” shape. This period was marked by consistent accumulation and higher lows.

- After the cup formation, there was a brief pullback, creating the “handle.” This short-term consolidation hinted at temporary profit booking but held key support levels.

- The most striking observation? The 100-day Moving Average acted as a strong support line during the formation of the cup. The price bounced multiple times around the 100 MA, reinforcing its significance in this setup.

- A clean breakout above the neckline has just taken place, with strong volume backing the move — a critical sign of conviction.

The confluence of the pattern breakout and 100 MA support makes this an intriguing development for technical traders.

📊 Why This Pattern Stands Out

Not every breakout is worth chasing, but in this case, several factors strengthen the bullish case:

1. Kaynes Technology Share Price took Support from 100 MA

The 100-day moving average is a commonly used indicator among swing and positional traders. In the case of Kaynes Technology, the price found support on this line during the formation of the cup, indicating that longer-term trend followers were stepping in to buy at these levels.

2. Clear Neckline Break

The neckline was a well-defined horizontal resistance level where previous rallies were rejected. Once the stock pierced through it with a strong green candle, it signaled a technical breakout with solid buying momentum.

3. Healthy Volume Spike

A breakout without volume can be a trap. But here, the volume accompanying the breakout is significantly higher than average. This adds confirmation that institutional money may be involved, which is typically a good sign of sustained momentum.

4. Pattern Symmetry

The overall structure of the Cup with Handle is symmetrical and clean — which means it’s not forced or distorted. Traders often give more weight to such “neat” formations as they align well with price psychology.

🔍 Market Psychology Behind the Pattern of Kaynes Technology Share

Cup with Handle patterns tell a story — a story of optimism, caution, and renewed confidence:

- The cup represents investors regaining confidence after a downtrend or sideways phase.

- The handle reflects a final shakeout or hesitation, where weaker hands exit.

- The breakout is when optimism returns with full force, and both retail and institutional investors jump back in.

In Kaynes Technology’s case, we see this entire story play out, with the final chapter — the breakout — just beginning.

🧠 How Traders Can Approach This

While it’s never advisable to jump into a trade blindly, the current breakout in Kaynes Technology does present a promising setup for swing or positional trades. Here’s how some traders might approach it:

- Entry Zone: Many traders prefer entering on the breakout or on a retest of the neckline, if one occurs.

- Stop Loss: Typically placed just below the handle low or under the 100 MA, depending on individual risk tolerance.

- Trailing Strategy: Once the trade is in profit, using a trailing stop can help protect gains while staying in the trend.

🧭 No Targets, Just Trend Riding

Unlike traditional recommendations that focus on target prices, seasoned traders know that the real power lies in riding the trend. With Kaynes Technology breaking out of a bullish continuation pattern, the focus should be on managing risk, monitoring volume, and trailing stops — rather than predicting an exact price point.

🧩 Final Thoughts

Technical patterns are not about guarantees but about probabilities. In the case of Kaynes Technology, the combination of:

- a clean Cup with Handle pattern,

- 100 MA support,

- and a volume-backed breakout

makes this a high-probability setup that deserves attention.

Of course, all trading decisions should be backed by your personal research, risk management, and comfort with market volatility. Patterns like these work best when viewed as part of a larger strategy, not as isolated signals.

So, whether you’re a technical trader, a pattern hunter, or just learning the ropes — this could be a stock worth watching closely in the coming weeks.

📌 Stay Updated on Kaynes Technology Share

Follow the chart, watch the price action, and stay alert for potential pullbacks or retests that could offer better entries. And as always, don’t forget the golden rule of trading — protect your capital.

Leave a Reply