🔍 Introduction: Radico Khaitan Share Price Signals Strength

Radico Khaitan has established itself as a dominant player in the Indian spirits industry, boasting eight millionaire brands and a strong presence in premium and luxury liquor segments. The stock is currently trading at ₹2,538, with a market cap of ₹33,964 Cr. Investors are keenly watching Radico Khaitan Share Price and its Cup with Handle Pattern and 100MA above 200MA, signaling potential bullish momentum.

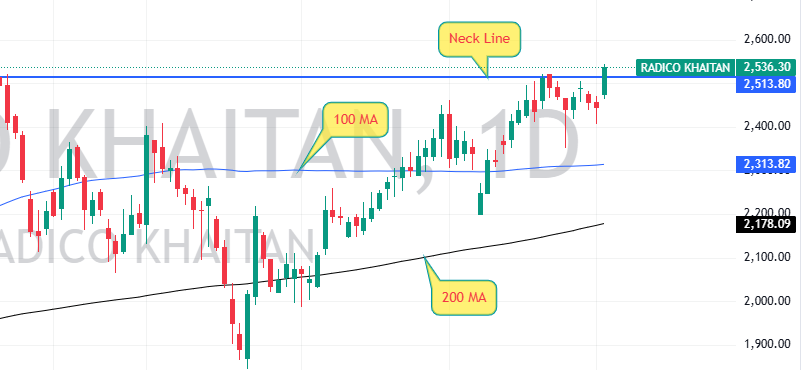

📊 Understanding the Cup with Handle Pattern of Radico Khaitan Share Price

The Cup with Handle Pattern is a well-known technical formation that suggests a continuation of an uptrend. It consists of:

- A rounded bottom indicating a period of consolidation.

- A slight downward drift, representing a temporary pullback before a breakout.

In Radico Khaitan’s case, the neckline of the pattern is a key resistance level. If the stock price successfully breaks above this neckline, it could trigger a strong upward movement.

📉 Moving Averages: A Bullish Confirmation

The 100MA above the 200MA is a significant bullish signal. This suggests that the stock’s recent momentum is stronger than its long-term trend, often leading to sustained price appreciation.

🔥 Key Technical Indicators of Radico Khaitan

Based on recent market data, Radico Khaitan Share Price exhibits the following:

- Relative Strength Index (RSI)📊: Neutral, indicating balanced momentum.

- MACD📉: Slightly bearish, but improving.

- CCI & ADX📈: Showing buy signals, reinforcing bullish sentiment.

- Pivot Points📍: Resistance levels at 2,533.80 and 2,602.60, with support at 2,373.00.

Key Technical Indicators of Radico Khaitan Share Price with Table

| Indicator | Value | Interpretation |

|---|---|---|

| RSI | Neutral | Balanced momentum |

| MACD | Slightly bearish | Improving trend |

| CCI & ADX | Buy signals | Reinforcing bullish sentiment |

| Pivot Points | Resistance at ₹2,533.80 & ₹2,602.60 | Support at ₹2,373.00 |

🚀 Market Outlook for Radico Khaitan Share Price

Given the Cup with Handle Pattern and the 100MA above the 200MA, Radico Khaitan’s stock is poised for a potential breakout ⚡. Traders should monitor the neckline resistance and volume trends to confirm the move.

📊 Fundamental Analysis: Financial Strength & Growth Potential of Radico Khaitan

Radico Khaitan’s financials indicate strong profitability and growth potential, supported by premiumization, backward integration, and strategic expansion.

📌 Key Financial Metrics of Fundamental Analysis of Radico Khaitan

| Metric | Value | Interpretation |

|---|---|---|

| Market Cap | ₹33,964 Cr | Large-cap stock |

| Current Price | ₹2,538 | Near 52-week high |

| High / Low | ₹2,638 / ₹1,429 | Volatility observed |

| Stock P/E | 109 | Expensive valuation |

| Book Value | ₹187 | Premium valuation |

| Dividend Yield | 0.12% | Low dividend payout |

| ROCE | 13.2% | Efficient capital utilization |

| ROE | 11.3% | Moderate return on equity |

| Debt to Equity | 0.36 | Manageable debt levels |

| Net Profit | ₹311 Cr | Strong earnings growth |

| Profit Growth | 31.8% | Robust profitability expansion |

| Promoter Holding | 40.2% | Stable ownership structure |

| Public Holding | 16.0% | Moderate retail participation |

🚀 Growth Drivers & Market Outlook of Radico Khaitan

Radico Khaitan’s strategic expansion into premium and luxury segments, coupled with strong brand positioning, is expected to drive revenue and earnings growth.

🔥 Key Growth Catalysts

- Premiumization Strategy: Increasing focus on high-margin products like Rampur Indian Single Malt and Jaisalmer Indian Craft Gin.

- Backward Integration: Investment in grain-based ENA production ensures quality control and cost efficiency.

- Market Expansion: Growing presence in Maharashtra, Karnataka, Telangana, and West Bengal.

- Strong Distribution Network: Over 100,000 retail outlets and 10,000 on-premise locations.

📈 Future Projections

| Year | Revenue (₹ Cr) | EBITDA (₹ Cr) | Net Profit (₹ Cr) | EPS (₹) | ROE (%) |

|---|---|---|---|---|---|

| FY24A | 41,185 | 5,061 | 2,558 | 19.1 | 11.3 |

| FY25E | 47,361 | 6,626 | 3,437 | 25.7 | 13.7 |

| FY26E | 54,567 | 8,188 | 4,955 | 37.1 | 17.3 |

| FY27E | 63,377 | 10,150 | 6,610 | 49.5 | 19.6 |

💡 Final Thoughts

Radico Khaitan’s technical and fundamental indicators suggest a promising investment opportunity. The Cup with Handle Pattern and 100MA above 200MA indicate bullish momentum, while strong financials and strategic expansion reinforce long-term growth potential.

⚠️ Important Note: As per SEBI guidelines, we do not offer investment advice or target prices. Always consult with a SEBI-registered financial advisor before making investment decisions.

You can also see ” Cup with Handle Pattern” on PNB Housing Finance

Leave a Reply